- Sukanya Samriddhi Scheme

- Kanyadan Policy Guidelines

- Key Differences

Himanshu is a content marketer with 2 years of experience in the life insurance sector. His motto is to make life insurance topics simple and easy to understand yet one level deeper for our readers.

Reviewed By:

Raj Kumar has more than a decade of experience in driving product knowledge and sales in the health insurance sector. His data-focused approach towards business planning, manpower management, and strategic decision-making has elevated insurance awareness within and beyond our organisation.

Updated on Aug 07, 2023 4 min read

Sukanya Samriddhi Yojana Versus LIC Kanyadan Policy

Sukanya Samriddhi Yojna and LIC Kanyadan Policy are schemes launched to provide relief to parents bearing girl child. The motive of these schemes is to serve the wishes of parents who want to save money for the higher education and marriage of their girl child through small savings.

It is beneficial for both people with low income and high income. The two noticeable things about the schemes are that:

- It provides fixed income

- It assures the safety of the capital.

What Is Sukanya Samriddhi Yojna?

The central Government for the bright future of the daughters launched Sukanya Samriddhi Yojna. It is a small savings scheme under the Beti Bachao Beti Padhao scheme. It offers the best interest rate on small savings scheme.

Guidelines For Sukanya Samriddhi Scheme

- The account can be opened at any of the post offices or banks branch that provides this facility.

- Two accounts cannot be opened for a single girl child.

- After the age of 18 years, a maximum of 50% of the amount can be withdrawn for the higher studies of the girl child.

- The account can be opened in the name of the girl child before the age of 10 years.

- Documents like birth certificate, address of girl and guardian, proof of identity are verified and the same are to be submitted at the post office or bank.

- One can open an account with a minimum of Rs. 250

- Sukanya Samriddhi Yojna’s account can be transferred anywhere within the country (India).

- In case of death of the girl child:

1. The account can be closed showing the death certificate and the amount deposited can be given to the guardian along with interest.

2. The account can be closed in 5 years in case of a life-threatening disease.

LIC Kanyadan Policy

LIC Kanyadan policy is another version of the Jeevan Lakshya Plan. The insurance agents have invented this name to sell the policy by the name of LIC Kanyadan Policy.

LIC Kanyadan Planis a plan that is beneficial for the future of a girl child. It is a saving scheme that helps a father deposit money at a low premium for education and marriage of the girl child. All the account activity is functioned by the father. In this, the girl child does not have access to the account. The plan provides the father’s post-death benefits to the daughter. It helps the family and especially the girl child in hard times.

Guidelines for LIC Kanyadan Policy

- It protects the future of a female child financially and moreover, she can spend her life independently.

- The plan is offered by the Life Insurance Corporation.

- The father is eligible to buy the policy only in his name. The policy can not be bought by the name of the daughter.

- The premium payment time is limited.

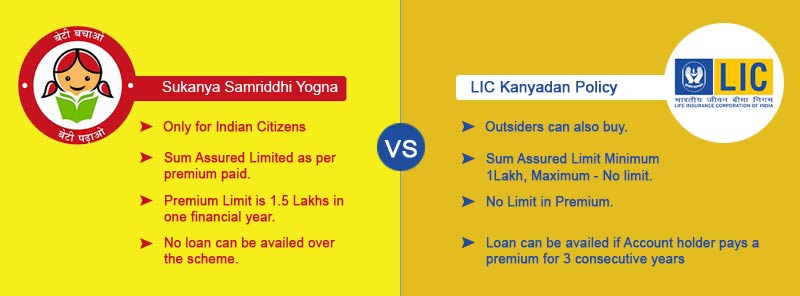

Differences Between Sukanya Samriddhi Yojna and LIC Kanyadan Policy

| Criteria | Sukanya Samriddhi Yojna | LIC Kanyadan Policy |

| Age Eligibility | The scheme can be bought after the birth of a girl child under her name and before she is 10 years old. | Father - 18 Years - 50 Years Daughter - At least 1 Year |

| Nationality Eligibility | Only for Indian Citizens | Outsiders can also buy. |

| Account Holder | The girl child is the holder of the savings scheme account until her marriage. | Father of girl child |

| Sum Assured Limit | Limited as per premium paid. | Minimum- 1 Lakh Maximum - No limit. |

| Premium Limit | 1.5 Lakhs in one financial year. | No limit |

| Account Maturity Tenure | A girl child can operate the account until the age of 21 or until she is married after 18 years of age. | 13 Years - 25 Years |

| Premium Payment Term | It is to be paid every financial year and not more than 1.5 Lakhs. | 3 years less than the policy term. |

| Loan Facility | No loan can be availed over the scheme. | If the account holder pays a premium for 3 consecutive years and the account is active then a loan can be availed. |

| Type of Scheme | It is a pure savings scheme launched for the girl children’s education and marriage purpose. | It has a mixed feature of the Jeevan Lakshya Policy. |

| In Case Of Death | In case the girl child’s (Account holder) death, the sum amount is paid to the parents at a normal interest. | In the case of the death of the father, the premium is waived off. |

| Compensation Offered By Scheme ( If the Account Holder Dies) | No such amount is paid. | Accidental demise - Immediate payment of 10 Lakhs Natural demise - Immediate payment of 5 Lakhs Suicide within 12 months from initiation of policy - 80% of the premiums are paid by the corporation except for the surrender value and the tax amount. |

Conclusion

Schemes like Sukanya Samriddhi Yojna and LIC Kanyadan Yojna have brought great help to the Indian parents. Birth of a girl brings responsibilities along with happiness. The benefits provided by both the schemes have been mentioned in a crystal clear way.

Life Insurance Companies

Share your Valuable Feedback

4.6

Rated by 857 customers

Was the Information Helpful?

Select Your Rating

We would like to hear from you

Let us know about your experience or any feedback that might help us serve you better in future.

Written By: Himanshu Kumar

Himanshu is a seasoned content writer specializing in keeping readers engaged with the insurance industry, term and life insurance developments, etc. With an experience of 2 years in insurance and HR tech, Himanshu simplifies the insurance information and it is completely visible in his content pieces. He believes in making the content understandable to any common man.

Do you have any thoughts you’d like to share?